AppleInsider is supported by its audience and may possibly earn commission as an Amazon Associate and affiliate associate on qualifying purchases. These affiliate partnerships do not affect our editorial information.

New study promises that Apple Pay out has surpassed Mastercard in the greenback price of transactions each year, with its $6 trillion complete this means it is over midway to equaling Visa.

Given that its launch in 2013, Apple Spend has viewed increasing adoption by consumers, financial institutions, and suppliers, right until in 2021 it accounted for 92% of all cellular wallet debit transactions.

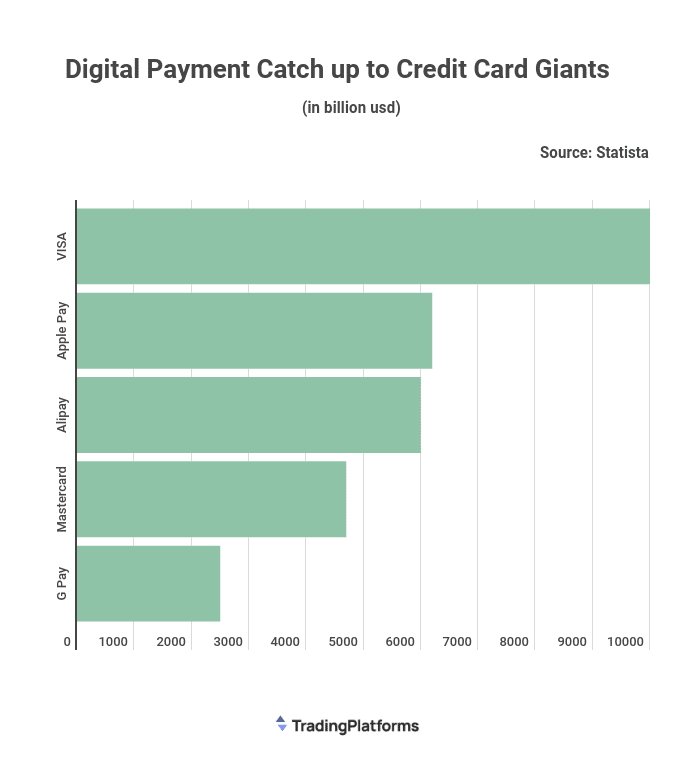

Now, in accordance to comparison website TradingPlatforms, Apple Pay out is the next most preferred electronic payment method, beaten only by Visa. The best-position Visa procedures close to $10 trillion value of transactions per 12 months, with Apple Shell out on above $6 trillion.

It signifies that for the initially time, Apple Pay has a total — together with Apple Card — has overtaken Mastercard, which procedures close to $4.8 trillion well worth of transactions. Apple Pay out has also crushed Alipay, which reportedly processes particularly $6 trillion truly worth of transactions.

Google’s G Enjoy is mentioned to be in fifth location, with all-around $2.5 trillion well worth of transactions.

“Apple Spend is increasingly turning into the go-to payment process for shoppers and firms alike,” stated Edith Reads, who is cited as a TradingPlatforms‘ finance skilled. “The fact that it has now processed much more transactions than Mastercard is a testament to its popularity.”

“Apple Shell out has an undue advantage and added benefits from their monopoly on Iphone NFC hardware,” she ongoing. “We hope to see Apple Spend continue on to improve in popularity and current market share in the coming yrs.”

The information introduced seems to be in the ballpark, at minimum, specified what we know about Apple’s economic results and transaction costs. The other corporations other than Google are more transparent about transaction quantity, and those people surface to be around suitable as effectively.

On prime of that, the description of Apple beating Mastercard is likely to be legitimate mainly because they and the other three corporations show up to have been as opposed above the same period. On the other hand, whilst the info is said to be through Statista and be drawn from “annual transactions,” TradingPlatforms does not specify what time period that is.

Therefore, it is not clear from regardless of whether this is in the past 12 calendar months, or for the duration of some unspecified money calendar year.

The TradingPlatforms‘ press launch reporting on its investigation is credited to author Edith Muthoni. But the LinkedIn web page for the finance professional she quotes below and in earlier articles or blog posts, Edith Reads, has the similar bio image that Muthoni works by using.